“The House Republicans are in chaos”. That is the common refrain these days from Democrats and most of the news media. In fact, the Republicans are following both the Constitution and the rules of the House of Representatives. Removing a Speaker and then electing a new one is one of the things our government was set up to accommodate. In this case, there is a very good reason why Kevin McCarthy was ousted. The federal budget is badly broken, and McCarthy lacks the courage to address the problem and take decisive action. Compromising with Democrats and the President to show a spirit of bipartisanship is not decisive action.

Federal spending is now so far out of proportion to federal income, it has become mathematically impossible to balance the budget. In fiscal year 2023, every discretionary program in the entire federal government could have been wiped out completely, including National Defense1, and we still would’ve run out of money before paying all the bills. It is patently silly to argue over a 2%, 10%, or 20% cut to any department or program when even a 100% cut won’t come close to solving the problem.

There are three main reasons this problem has become so acute:

- A large percentage of federal spending is taken up by social programs. Healthcare, Social Security, and Welfare collectively accounted for over 64% of all federal spending in 2023 (US Treasury website). These programs are considered “untouchable” in any budget discussion.

- Under President Biden, interest rates have skyrocketed to more than 4 times what they were under Presidents Obama and Trump. While high interest rates are a problem in many aspects of our lives (Mortgages, car loans, student loans, credit cards, etc.) they are particularly calamitous for the monthly interest payment the federal government must make on the national debt.

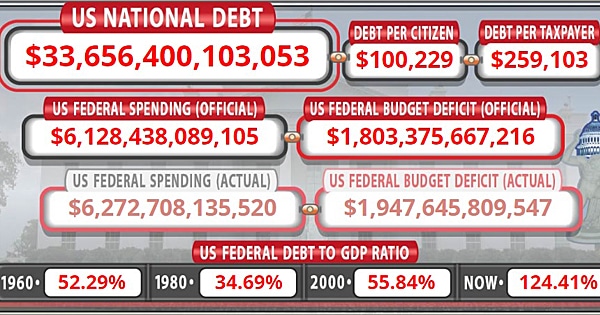

- The accelerated growth of the National Debt itself. In less than 3 years, the National debt has increased by more than 21% (6 trillion dollars). It now stands at $33.6 trillion dollars.

The combination of high interest rates and the sheer size of the national debt have increased the monthly interest payment on the debt so much it now accounts for 12% of all federal spending (a 33% increase from 2022). This is a “must pay” bill in the same way that all the social programs are categorized. When you add together the cost of the social programs plus the interest payment on the national debt you’ve already accounted for 4.56 trillion dollars of spending (76% of all federal spending).

The total tax revenue for the federal government in 2023 was 4.4 trillion dollars. See the problem? There wasn’t enough money to fund just the social programs plus the debt payment. What about all the rest of the federal government? This includes the Departments of Defense, State, Homeland Security, Transportation, Education, Treasury, Energy, Labor, Justice, Veterans Affairs, Commerce, Housing, Interior, the Supreme Court, all federal courts, the secret service, federal prisons, etc. All of these Departments and services must now be entirely funded with borrowed money. This is why it is no longer mathematically possible to balance the budget (have no deficit). The government would cease to exist.

Democrats and some economists argue that there is nothing wrong with continued borrowing and deficit spending. They claim the government can keep borrowing as long as the Gross Domestic Product (GDP) continues to grow. There are two main problems with this.

- As the debt gets bigger the monthly payment gets bigger and eats up an ever-larger percentage of the federal budget.

- Absent a major tax increase, the revenue part of the budget equation stays relatively the same. If spending increases (and most programs have built-in automatic annual increases) then the amount borrowed annually must, by definition, proportionally increase. That accelerates the growth of the interest payment on the debt even faster.

By the year 2030, the annual interest payment on the debt is projected to be over 1 trillion dollars. By 2050 the interest payment on the debt will consume more than half of all federal spending.2 Long before that, the debt payment will have become the government’s largest single budget item – bigger than Medicare, Medicaid, Social Security or National Defense.

Cutting spending is the only way to begin to make progress on this problem. Spending cuts must be large enough to stem the growth of the debt and the corresponding interest payment on that debt. As outlined above, that cannot be accomplished by taking three quarters of the budget off the table because it is considered “mandatory” spending. The only way the math works out for this is if the social programs are revamped so they consume a much smaller percentage of federal spending.3 Taking on these “sacred cows” requires a fundamental grasp of the real problem and a fearless determination to fix it. Kevin McCarthy has neither.

Suspicion that McCarthy did not have a strong enough conviction or character to effectively attack the federal spending problem was a big part of why it took 15 votes to get him elected Speaker in the first place. It turns out that suspicion was well founded. He completely acquiesced to the Democrats and President Biden on the debt ceiling debate last spring. Then just last month he made a deal with Democrats on a continuing resolution for the 2024 budget rather than taking a hard line on spending cuts. McCarthy had to go.

It is the Democrats who are willing to bring us to the brink of a government shutdown and/or a credit default to preserve their insatiable appetite for more spending. Supported by the news media, they always play a better game of blame and brinksmanship in this debate, making you believe it is Republican recklessness and chaos (their favorite new word) leading us to ruin. Consequently, meaningful spending cuts never materialize, and the problem described above continues to accelerate.

We need a leader able to provide a shock to the system. And we need one now.

1 The most important duty of the federal government, which is specifically described in the very first sentence of the Constitution, is to “…Provide for the Common Defense”. For the first 120 years of our country’s existence, National Defense accounted for almost 100% of the federal budget. In 2023, the Defense Department was only 13% of all federal spending.

2 From the non-profit Peter G. Peterson Research Foundation.

3 Many Democrats claim that this entire problem can be solved with a huge tax increase on high earners and corporations. However, there is a math problem there too. The deficit numbers are now so high, there isn’t enough money available from the income of the highest earners to cover the budget deficit (even if they are taxed at 100%). And we already know what big corporations do if their US tax burden gets to the point where it puts them at a disadvantage with their international competitors. They leave.