With a big federal budget battle about to take place, we thought we’d try to cast a little perspective on this topic to help poke through what is very likely to be a lot of hyperbole and fake reporting from each side in the coming weeks.

Don’t worry, we are not going to drill down into numerical detail in this article. In fact, the federal budget today has come “full circle” so to speak, in that the basic concerns are now so obvious that they are very easy to understand. Because of that, it opens the door for a good discussion that anyone can weigh-in on.

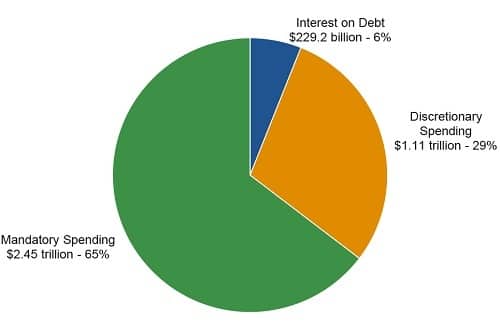

To start, we’re going to look at the 2015 budget since this is the most recent one with actual verified numbers and no estimates or projections. The government spends money in thousands of different categories, however it can be simplified into just three for this purpose:

The green section of this chart, the biggest by far, represents the money spent on entitlements – Social Security, Medicare, and Medicaid. The blue section of the chart is the interest we must pay annually on the national debt. The orange section contains everything else, including all the defense spending. The key takeaway from this chart for the coming 2017 budget debate is that all of the arguing, horse trading, yelling, sob stories, and the like, is entirely contained within only the orange section. As you can see from the chart, that section represents less than 30% of the overall budget. There will be no changes to entitlements, and the debt payment must be made.

The next important piece of context is the national debt. Since 2008, the national debt has just about doubled – from 10.7 trillion dollars to 20 trillion dollars. While there are a lot of debatable justifications for why this happened and how urgent a problem it actually is, our only reason for mentioning it here is the size of the blue wedge (interest on the debt) in the pie chart. That blue wedge has grown since 2008 because the size of the debt has grown. However, it has not grown nearly as much as it ordinarily would have since interest rates have been held artificially low during all that time. Interest rates began to rise again last year, and we just had another rate increase this month. That means even without a further increase to the national debt, the blue wedge will grow relative to the rest of the pie as interest rates continue to rise. If we also continue to add even more to the national debt, the blue wedge will grow even faster.

So where does that leave us? The current administration has decided not to change anything in the green wedge. And, as mentioned above, the blue wedge will be larger for 2017 and beyond with no hope of it shrinking unless the national debt is reduced. If our goal is not to go any further into debt, the orange wedge will have to get much smaller in order to balance the budget. In fact, in order to have balanced the budget for 2015, the orange wedge would’ve had to have been cut by more than half! Since slightly more than half of the orange wedge is for National Defense (our military), that means everything else would have to be completely eliminated in order to just “break even”.

Thus, the core of the budget debate devolves to a rather simple and stark choice. At current tax rates (the money the government takes in) the only services the government can actually afford are:

- Social Security

- Medicare and Medicaid

- Interest on the Debt

- National Defense

The President’s recently proposed budget for 2017 reflects exactly this reality. Unfortunately, the news media as well as many in Congress will spend lots of time and words on emotionally-charged appeals for the survival of programs not part of the above obligatory four. This serves to deflect attention from the elementary math problem at hand, and is therefore meaningless in the face of the immutable facts. Without going further into debt, there are only two ways to make room in the federal budget for services other than the four sacrosanct services mentioned above – increase revenue or reduce spending in one or more of the above four areas. This is the only legitimate budget debate to have. Everything else is just “window dressing” intended to prey on your emotions. Don’t fall for it.

There are some who believe we can just continue to take on more debt. On average, we have been spending $2 for every $1 we’ve taken in since 2001. Because of that, it seems almost “normal” to continue overspending. As mentioned earlier though, that blue wedge will be squeezing out the other parts of the budget more quickly now with interest rates rising back to normal levels. It will have a much quicker and more devastating effect if we add even more to the debt while the rates are rising.

Did we always have this problem? A historical look at the federal budget is fascinating. For most of our country’s existence (up to the mid-1930’s), the federal budget consisted mainly of two items – Defense spending and interest payments on debt. Since much of our debt was incurred by borrowing money for the military to fight various wars, National Defense alone was the main thing we spent money on during our first ~150 years as a country. Today, National Defense is a mere 15% of the federal budget. This is the lowest percentage it’s ever been in our history, despite the fact that “a common defense” is the only item stated in the constitution that would be “provided” for our union. This is in the first sentence of The Constitution. The harsh reality is that since World War II, entitlement programs have come to hog-tie the federal government. Assuming we do not allow ourselves to plunge deeper into debt, the government can do nothing beyond paying these entitlements, protecting our nation (the military) and making our debt payment. Absent a large tax increase (unlikely with a Republican congress) or a further reduction in Defense spending (also unlikely), it comes down to a choice between entitlements and everything else. At some point soon, the real, honest, and painful discussion on the future of entitlement spending must occur.

One Response

Bye bye, public television…..a world without Big Bird, wow.